As a client was going through a divorce, we helped her visualise her future finances to provide reassurance she could maintain her current standard of living and help her children financially when they are older.

The results

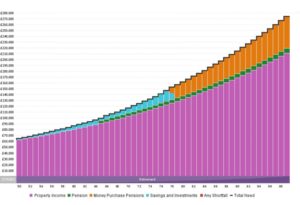

The use of cashflow planning helped us to develop a comprehensive financial plan that would enable Jane to understand what the proposed divorce settlement would mean for her and her children. In addition, it provided the reassurance that she would be able to manage her expenditure and allow her to make informed decisions with regard to both investments and estate planning. Finally, the plan was able to show Jane that she could afford to assist her children in buying their first homes, which was very important to her.

The ‘clean break’ divorce settlement involved Ben transferring his personal pension in full to Jane. This would help fund her expenditure in retirement, along with a final salary pension from her employment with the civil service. Jane will also request a forecast in respect of her state pension entitlement. Her personal cashflow plan also helped to identify the most tax-efficient strategy for the drawdown of her assets to meet her expenditure needs

We were also able to show her a number of different scenarios with regard to the buy-to-let property portfolio, should she wish to consider selling some of the properties in the future.

Last, but not least, Jane was reassured that the split of the assets would enable her to maintain her current lifestyle and not have to worry about going back to work (given her ill health), as the cashflow chart was not showing any red (indicating a shortfall between income needs and that which the financial assets could yield).

With the plan in place, we schedule a date for 12 months’ time given it is important that it is reviewed each year to take into account any lifestyle changes, and to ensure Jane remains on track to achieve her objectives.

In 2021, we held a series of three webinars focusing on divorce. These were: Managing your finances around a divorce; Divorce: beyond the financial and legal ramifications; and Divorce, pre-nups and pandemics – recent changes and those coming soon.

You can catch up on all of these demand on this website via the provided links. Please note that following the recording of these webinars the introduction of the 2020 Divorce Bill was postponed to April 2022.

Related news

You may also be interested in the following Insights

Contact

Get in touch to find out how we can help you with your financial challenges.

Clients of Nedbank Private Wealth can get in touch with their private banker directly to understand how wealth planning can help them achieve their financial goals and objectives, or call +44 (0)1624 645000 to speak to our client services team.

If you would like to find out more about how we can help you with wealth planning support, please contact us on the same number as above, or complete the contact us form using the link below.

Any examples of investments and structures used are for illustrative purposes only. This webinar does not constitute an invitation or inducement to buy any financial investment or service. None of the content constitutes advice or a personal recommendation. Individuals should seek professional advice, based on their jurisdiction and personal circumstances, before making any financial decision.

Related case studies

Read about more clients we have helped

We have helped countless high-net-worth clients with their financial needs – some straightforward, some complex. Our bespoke approach, where we really get to know our clients, allows us to offer solutions that other wealth planners and private banks aren’t able to.