A couple in their mid-30s were keen to make sure they were on track for retirement, and plan for unexpected shocks, and see what ‘good’ looked like.

The results

The cashflow modelling exercise helped us to come up with a new financial plan that would address some of the issues that had been highlighted.

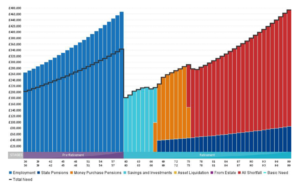

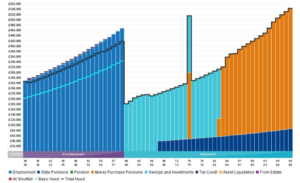

The wealth plan developed showed the couple that any of their surplus income, that Clara and George were set to earn in the years before they retired, could be used to increase their pension contributions, on which they could claim additional tax relief. The potential gains from each of them investing in ISAs, up to their maximum individual allowances each year, were also highlighted. In addition, through the use of our financial profiler, and in conjunction with discussions with one of our investment specialists, the couple also increased the level of investment risk being taken given that their attitude to risk permitted the opportunity for higher returns.

We were also able to show them a number of different scenarios based on the ‘what ifs’ we had initially set out, and the couple is now considering some insurance to help protect against the loss of anticipated future income.

On retirement, the couple would be able to draw income down from the account that has is the least tax-efficient first i.e. their general savings, and then their ISAs, before starting to draw down on their pension, which would now last throughout retirement.

Related news

You may also be interested in the following Insights

Contact

Get in touch to find out how we can help you with your financial challenges.

Clients of Nedbank Private Wealth can get in touch with their private banker directly to understand how wealth planning can help them achieve their financial goals and objectives, or call +44 (0)1624 645000 to speak to our client services team.

If you would like to find out more about how we can help you with wealth planning support, please contact us on the same number as above, or complete the contact us form using the link below.

Investment values can go down, as well as up, to the extent that you might get back less than you originally invested. The value of your investments may also be affected by exchange rates. The inclusion of any investment structures and wrappers is for information only and should not be taken as advice or a recommendation. You should seek the necessary advice, specific to your circumstances, before making any financial decision.

Related case studies

Read about more clients we have helped

We have helped countless high-net-worth clients with their financial needs – some straightforward, some complex. Our bespoke approach, where we really get to know our clients, allows us to offer solutions that other wealth planners and private banks aren’t able to.