Investing|Money management

The opportunity cost of cash

One upside to the steady stream of central bank rate hikes is that higher interest is now finally being paid on cash savings. After years in which returns on cash were virtually zero, savings accounts paying over 5% may sound appealing, but is cash an answer for your long-term goals?

Cash might be particularly appealing given it comes after three long and difficult years. First, we had Covid-19, which felt like the world as we knew it was coming to an end. Then, just when we thought we were returning to normal times, Russia invaded the Ukraine and almost simultaneously, after years of ultra loose monetary policy, inflation assaulted our economies. Interest rates, which had remained at historically low levels since the financial crisis in 2008-09, suddenly started to rise as central banks increased their base rates to battle rampant inflation. With thirteen base rate rises in the UK alone since December 2021, cash now offers a decent rate of return, so can it be a welcome shelter from the turbulence of financial markets?

There is no straightforward answer that covers all scenarios. Much will depend on your financial circumstances, composure when faced with volatile returns, and time frames, but as a general rule cash is not a suitable long term investment. This is true in general, but particularly now.

Cash – the smiling knife

There is no doubt that cash feels safe. But what is the price demanded for that safe, comfortable feeling? Is it robbing you of opportunity?

Whether you’re invested and tempted to move your money into a savings account, or whether you’re a long-term cash holder who has been waiting for an opportunity to invest but now finds cash looks attractive, there are a few things you should consider:

- Cash is returning significantly less than inflation – you will be accepting a real term loss with immediate effect until inflation drops (at which point cash rates are also likely to drop). A gap as low as 3% between your returns and the inflation rate would halve the value of your money over 24 years.

- Ah, I hear you say, but I don’t intend to hold cash over 24 years. This is only temporary. OK, I would answer, but when you do decide to jump from cash back into the stock market, it’s likely you’ll pay a lot more for the shares you buy. Why? I’ll cite just two out of a number of reasons:

- The maxim of “buy low, sell high”. Aside from a handful of technology stocks (Nvidia being the prime example) equity valuations are either fair value or cheap. This is the time to buy, not to sell. Would you sell in a housing slump? Probably, not. Neither should you sell in a stock market slump.

- Markets are rising 80% of the time.* This means that when you can no longer get the current rate on your cash deposit, you might look back at today’s prices and wish you had invested more now.

If you’re currently invested, it’s also worth remembering that while the bottom number on your investment statement may have moved up and down rather uncomfortably recently, any losses are not locked in unless you decide to sell.

It’s also worth remembering that our portfolios are so highly diversified that the likelihood of significant, permanent loss of capital is minimal. In fact, the biggest risk to your capital is the human tendency to sell at the wrong time.

Capturing the opportunity

It’s easy to get caught up on the negative headlines, particularly as there’s a tendency not to publish positive news, but it’s inevitable that threats breed opportunities.

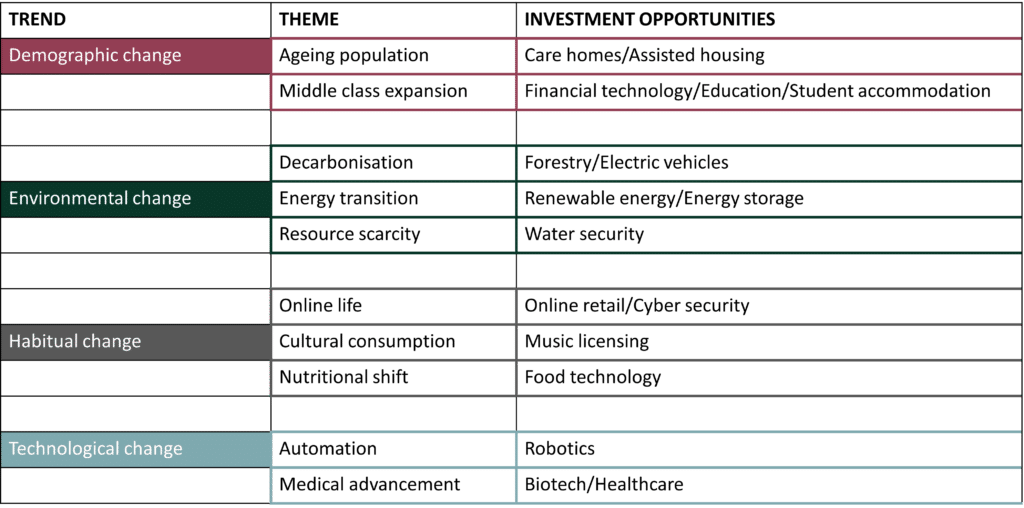

Our focus is on managing the threat and capturing the opportunity. Environmental change, an aging population, a shift in spending patterns, artificial intelligence – all of these are long-term opportunities which we are nurturing within your portfolios and can exploit, along with opportunities the market throws at us to buy cheaply.

Below are four key areas of change where we currently see investment opportunities:

Everyone’s circumstances are different and there might be good reasons to hold some of your assets in cash. But you should always consider this as part of a professionally thought-out financial plan, often in conjunction with your wealth planners, tax advisers and legal specialists.

If turbulent markets are causing you concern, or if you feel now might finally be the time you have been waiting for to invest, speak to your private banker. They can explore your options, including cash, and ensure they still match your appetite for risk and your long-term financial goals.

Clients of Nedbank Private Wealth can get in touch with their private banker directly to understand more about how we manage money on their behalf, or call +44 (0)1624 645000 to speak to our Client Services team.

If you would like to find out more about how we manage clients’ investments, please contact us on the number above or via our Contact us page.

Sources: Fidelity – Here’s how to defeat inflation, Nedbank Private Wealth: MSCI World, 12 month periods – March 1990 – December 2018

Investments can go down, as well as up, to the extent that you might get back less than the total you originally invested. Exchange rates also impact the value of your investments. Past performance is no guide to future returns. Any individual investment or security mentioned may be included in clients’ portfolios. They are referred to for information only and are not intended as a recommendation, not least as they may not be suitable. You should always seek professional advice before making any investment decisions.

Author

Rebecca Cretney

Senior Investment Specialist , Isle of Man

Rebecca joined Nedbank Private Wealth in May 2004 having moved to the Isle of Man from Barcelona to pursue a course in Business Studies with the Isle of Man Business School. She worked as a private banker until 2019, when she was appointed to the role of investment counsellor. Rebecca now focuses exclusively on supporting private bankers in conversations with their clients, providing technical investment expertise where more complex portfolio requirements exist. She also provides coaching and training for the private banking teams on a wide range of subjects surrounding investment and advice. In addition, Rebecca chairs the bank’s Investment Committee.

Rebecca is a Chartered Fellow of the Chartered Institute for Securities & Investment and a Chartered Wealth Manager.

RELATED NEWS

You may also be interested in the following Insights

Sign up for our updates

Stay up to date with the latest news, insights, and opinions from Nedbank Private Wealth by signing up to our newsletter. You can also register to be invited to our virtual events and hear directly from a wide range of experts. Sign up below. You can unsubscribe at any time.