Investing

Navigating a permacrisis: An investment perspective

When a significant global event occurs, investors often react with a flurry of activity in the market. In recent years, we have witnessed a fair share of such events, which has left us feeling like we are in a period of permanent crisis, or a ‘permacrisis’. As always, we remain calm and vigilant to what is happening with our investments.

In October of last year, our Head of Wealth Planning, Simon Prescott, considered how to navigate the emotional impact of a permacrisis and how to avoid being pressured by external influences. If you haven’t already, I recommend reading Simon’s article.

In this article, I’ll expand on Simon’s points, and consider the wider impact the permacrisis has on markets, when you should invest, and what we can expect to shape the markets for the year ahead.

A look back at the past two decades

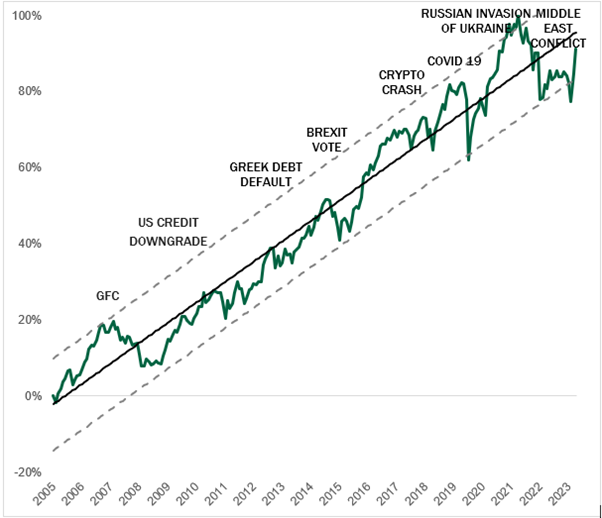

Over the past two decades, we have witnessed numerous significant global events and crises. However, it is worth considering how much these events have affected the stock market and, in turn, your investments.

You will see from the below graph (which uses a portfolio in the middle of our risk range as an example) that between 2005 and 2023 the value of this investment continued to rise despite the volatility in the market over this timeframe.

If you had invested in 2005, this graph shows where you would be today if you had held on through the turbulence of the past two decades.

During this period, the world witnessed the global financial crisis, Brexit, and the spread of COVID-19. In addition, numerous conflicts and significant political elections also took place. Despite these events and the volatility that ensued, markets continued to rise. This is because the stock market is forward-looking and considers future earnings potential.

When considering the best time to invest, place your goals and time frames first and news headlines a distant second. If you’re looking for long-term growth, then it’s best to stay invested in the market and not panic during short-term volatility. It will be our job as your portfolio manager to tilt the portfolio to mitigate the downside and capture the upside. We do this through short term tactical tilts. Working with our specialist team of experts can help you understand the risk factors at play in order that you make the best decisions during these turbulent times.

What to expect in 2024 and beyond

We don’t expect to see the end of this permacrisis any time soon. In fact, more global events in 2024 are anticipated, which will create a sense of uncertainty. But uncertainty, although uncomfortable, creates opportunity. Already this year, the world is keeping a close eye on the wider effects caused by the war in the Middle East, as tensions escalated in the region.

Not only this, 2024 is set to be the biggest year in election history, with more than two billion voters expected to go to the polls in 50 countries , including the US, UK, and India. The US election, taking place in November, is at the forefront of many minds as in many respects it sets policy for the world.

Market experts have been avidly sharing their thoughts on the impact the result could have on the wider economy and stock markets. While Trump is seen as a divisive character, many analysts agree that he represents lower tax and less regulation from a financial perspective, which could lead to a sharp rise in markets. On the other hand, analysts broadly agree the Biden administration has brought a period of prosperity, stability and growth to the US economy, which has flourished despite some serious headwinds, with unemployment figures remaining low.

It is feasible that the US economy will flourish whoever wins the election, whilst the ramifications for the rest of the world remain to be seen.

Navigating investments during turbulent times

We have seen that when a significant global event occurs, investors often react with a flurry of activity in the market or taking shelter in cash. The question is: is this right? More often than not, the answer is no. This is usually the time to trust your advisers, trust your plan and make the active decision to remain in the markets for the long term. Allow your portfolio manager to maximise the opportunity volatility creates.

If you set your eye on a life goal, prepare in advance for any eventuality the journey might throw, instead of changing the goal midway, at the sight of a storm. Investment storms are a natural part of investing, and your investment manager should be equipped to deal with them.

How Nedbank Private Wealth is supporting our clients through this permacrisis:

Our dedicated team offers an award-winning end-to-end service, whatever your financial needs, to leave you feeling ready for whatever the future holds.

Your tailored wealth plan will prepare you for your journey and clearly be anchored on the goals that are most important to you. Our investment team will manage a portfolio of assets to power that journey. By taking this approach we aim to capture the upside and minimise the downside of your portfolio to best suit your risk tolerance.

Our experienced private bankers, with the support of specialist teams, help you adapt to changing circumstances, providing you with a sense of control and reducing the fear of the unknown.

1 Why 2024 is a record year for elections around the world | World Economic Forum (weforum.org)

Author

Rebecca Cretney

Senior Investment Specialist , Isle of Man

Rebecca joined Nedbank Private Wealth in May 2004 having moved to the Isle of Man from Barcelona to pursue a course in Business Studies with the Isle of Man Business School. She worked as a private banker until 2019, when she was appointed to the role of investment counsellor. Rebecca now focuses exclusively on supporting private bankers in conversations with their clients, providing technical investment expertise where more complex portfolio requirements exist. She also provides coaching and training for the private banking teams on a wide range of subjects surrounding investment and advice. In addition, Rebecca chairs the bank’s Investment Committee.

Rebecca is a Chartered Fellow of the Chartered Institute for Securities & Investment and a Chartered Wealth Manager.

RELATED NEWS

You may also be interested in the following Insights

Sign up for our updates

Stay up to date with the latest news, insights, and opinions from Nedbank Private Wealth by signing up to our newsletter. You can also register to be invited to our virtual events and hear directly from a wide range of experts. Sign up below. You can unsubscribe at any time.