Investing

How will the US election affect your investments?

As the US presidential election on the 5th November draws closer, discussions around its impact are heating up. With the US having a large economic, political, military, cultural, technological, scientific and environmental influence globally, the ramifications of either candidate winning the race could not be more significant.

Equity Markets

In my job as investment counsellor, I have the pleasure of meeting clients on both sides of the blue and red divide: some who would vote Republican and others Democrat. And it strikes me that a common concern is ‘How will the elections affect my portfolio, especially if my preferred candidate doesn’t win?’. Other variations on this question are ‘How will Trump / Harris winning affect equity markets?’ or ‘Should I delay an investment until after the election to see if Harris / Trump gets in?’. The sentiment behind these questions is anxiety: a fear of the unknown, tinged with an edge of fear of missing out. If you feel this fear, you are not alone. Financial markets hate uncertainty, to the extent that bad news is preferable to waiting for results – but is the fear justified? To answer this we can look at two things: the past (and the lessons to be learned from it) and broad impacts of each candidate’s policy.

The past

Historically, US equity markets have performed positively under both Democratic and Republican administrations. Since 1929, only three presidents – Herbert Hoover, Richard Nixon, and George W Bush – experienced negative annualised stock returns during their terms. While political leadership certainly plays a role, stock market performance is influenced by a myriad of factors beyond that, including unexpected events like the 2008 financial crisis.

Although historically, average returns for the S&P 500 have tended to be higher during non-election years, election years are more likely to be positive than non-election years1 . Since 1926, only four US election years ended in negative territory with major losses only occurring because of significant geopolitical or financial disruptions, as opposed to the election itself. This suggests that political uncertainty may not be as detrimental to markets as some might believe. In contrast, in non-election years, the S&P 500 has experienced annual losses nearly twice as often2.

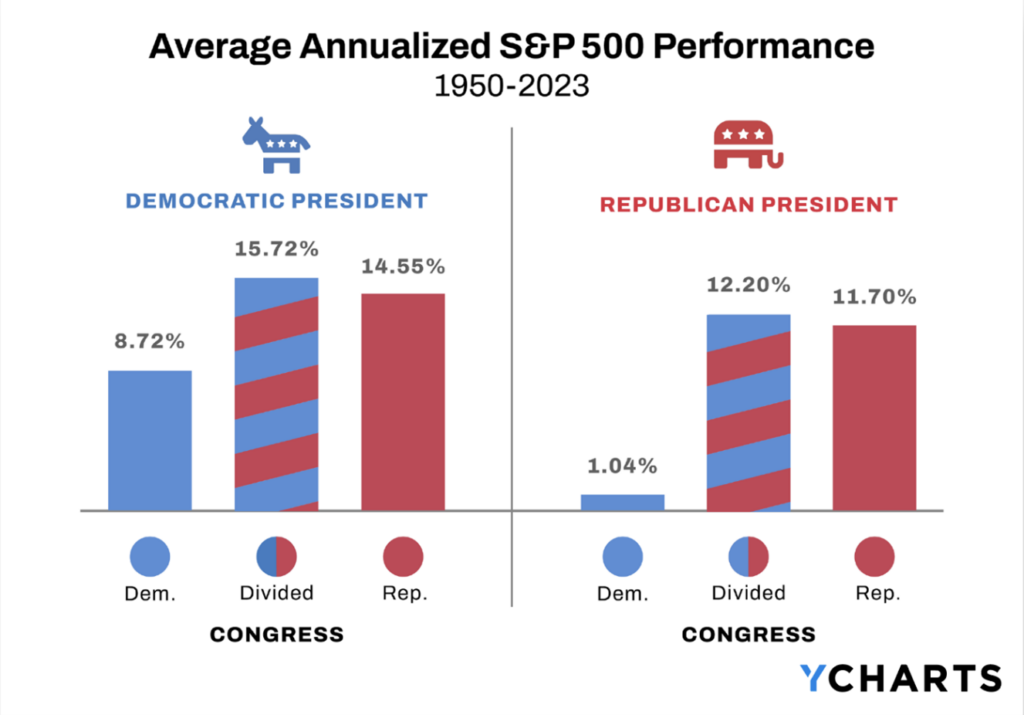

Source: YCharts

Election year returns are often influenced by whether the incumbent is running for re-election, as this reduces uncertainty. Additionally, factors like economic and geopolitical events, as well as the perceived market impact of each candidate’s policies, play significant roles.

The policies

The Republican Party have a reputation for being ‘market-friendly’. They are more likely to lower taxes and reduce regulation, which leads to lower corporate costs and therefore increases profitability.

However, historical data doesn’t conclusively show that stock market performance is better under Republican leadership. In fact, the opposite is marginally true. What data does reveal is that markets have thrived under both Democratic and Republican administrations3.

A divided Congress, which signals slower legislative changes, tends to be favoured by markets, perhaps as it represents the status quo and reduces uncertainty.

The Trump vs Harris economic outlook

For investors trying to discern the possible outcomes of the 2024 election, it’s helpful to consider various scenarios.

Scenario 1: Donald Trump Returns to the White House

If Donald Trump returns to the White House with full control of Congress, we might expect policies similar to those of 2016. However, the circumstances now are very different from 2016. Taxes are lower, the US has a higher fiscal deficit, and increased bond yields will likely necessitate a different market response to fiscal expansion.

- Potential Winners: Oil and gas majors (due to extended fossil fuel policies) and financials (due to decreased regulation).

- Potential Losers: Utilities (which house significant renewable infrastructure), industrials (due to a likely rollback of some Inflation Reduction Act provisions), and international stocks (as “America First” policies lead to increased protectionism).

Scenario 2: Kamala Harris Presidency

A Harris term would likely see more support for green tech and large infrastructure projects, as demonstrated by the Inflation Reduction Act, the Chips Act, and the Infrastructure Investment and Jobs Act. Pharmaceuticals could face increased regulation under Harris, but overall, this outcome would likely not represent a huge departure from the Biden administration.

The Bond Market

The only president on course to have negative bond yields in his presidency is Biden. While interest rates have tended to be higher under republican presidents, it is important to remember that the president does not directly control bond markets. The Federal Reserve holds sway over monetary policy, interest rates, still, bonds could see varying impacts depending on which candidate shapes fiscal policy and influences the Federal Reserve Board.

The effect of timing the market based on ‘my candidate of choice’

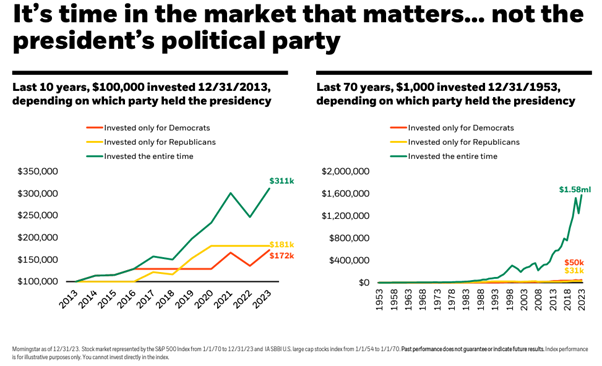

A study conducted by BlackRock helps highlight the folly of investing on the basis of a presidential candidate being elected.

In the first graph an investor sees $100,000 grow to $311,000 over 10 years if they remain invested regardless of who is president. However, that same investor would see returns decimated if they had only remained invested during their preferred political party’s administration.

The second graph is even more startling, as the time frames are widened to 1953. This highlights the power of compounding returns and leads to the inevitable conclusion that it is indeed time in the market and not timing the market (or political party!) which matters.

Source: BlackRock

Keep an eye on your long-term goal

Investors often react impulsively, waiting for election results before making investment decisions. However, historical data strongly supports staying invested during election years, regardless of the outcome, even one as significant as the US election.

While election results may influence short-term market volatility and should inform tactical portfolio positioning, staying invested, diversifying portfolios, and focusing on broader market trends have proven to be the best strategies for navigating the uncertainty that elections bring.

Navigating the stock market during this time can be complex. Our experienced investment specialists and private bankers are here to help you adapt to changing circumstances, providing you with a sense of control and reducing the fear of the unknown.

1What Should Investors Expect From The Market This Election Cycle? (forbes.com)

2What Should Investors Expect From The Market This Election Cycle? (forbes.com)

3Election 2024 Update: It’s Policy, Not Party, That Matters (signatureia.com)

Author

Rebecca Cretney

Senior Investment Specialist , Isle of Man

Rebecca joined Nedbank Private Wealth in May 2004 having moved to the Isle of Man from Barcelona to pursue a course in Business Studies with the Isle of Man Business School. She worked as a private banker until 2019, when she was appointed to the role of investment counsellor. Rebecca now focuses exclusively on supporting private bankers in conversations with their clients, providing technical investment expertise where more complex portfolio requirements exist. She also provides coaching and training for the private banking teams on a wide range of subjects surrounding investment and advice. In addition, Rebecca chairs the bank’s Investment Committee.

Rebecca is a Chartered Fellow of the Chartered Institute for Securities & Investment and a Chartered Wealth Manager.

RELATED NEWS

You may also be interested in the following Insights

Sign up for our updates

Stay up to date with the latest news, insights, and opinions from Nedbank Private Wealth by signing up to our newsletter. You can also register to be invited to our virtual events and hear directly from a wide range of experts. Sign up below. You can unsubscribe at any time.