Investing|Money management

Bonds are back: the return of the “old normal” and active management

Are we seeing a return to the ‘old normal’? Bonds are back and active managers want to utilise the opportunity for clients, by targeting attractive bonds and avoiding the worst. Louis Hutchings explains.

- Over the last 15 years, Quantitative Easing (QE) has supported bond prices, supressed volatility and rewarded investors who adopted fixed income beta strategies.

- However, last year’s sharp rise in interest rates and market volatility has created opportunities for active bond managers to add value.

- In fact, our analysis reveals that in periods of high volatility, active bond managers have demonstrated a significantly higher likelihood of outperformance relative to periods of lower volatility.

- Interestingly, quality matters given the greater dispersion among manager returns during higher volatility. In other words, finding active managers with experience of navigating such market environments will be to key to investor success.

The end of QE marks a different approach to bond investing

It’s September 2008 and Ben Bernanke, the then Chair of the US federal Reserve, is about to lead the US economy into uncharted territory by using quantitative easing (QE) for the very first time.

A bold move, certainly. But he had little option other than to give it a try. The interest rate lever had already been pulled, and economies were at a juncture, with financial collapse or a dice roll the only options.

Thankfully, the dice roll paid off and economies have rebuilt themselves from their nadir, but not without a cost to market stability. The commitment to do “whatever it takes” had a profound impact on markets, where a doubling of core equity valuations, the longest running growth cycle, new highs for bond prices and bitcoin’s ascent to almost $100,000 are just a few examples of the resulting distortions.

Of course, lots has been made of the subsequent dialling up in risk across the industry – where asset managers tested the bounds of their mandates, overweighting risk wherever possible. A less explored area is the impact QE had on general bond market volatility.

But before we jump to that, let’s just first clear up what exactly we mean by volatility. A common misconception is that volatility is all about directionality. Instead, what we’d colloquially call “choppy” or “range bound” markets often exhibit greater volatility than aggressively moving, but directional ones.

Over the last 15 years, bond markets have mostly been directional, which is of little surprise when we think about the mechanics of QE. In its simplest form, QE is the process by which central banks buy longer term sovereign bonds in the free market. The impact of doing so pins down the yields of the bonds directly involved, as well as those bonds which are benchmarked against them (to which there are many thousands). With yields tightly controlled by central banks, price movement was positive, but limited – effectively forced to oscillate within constraints dictated by policy makers.

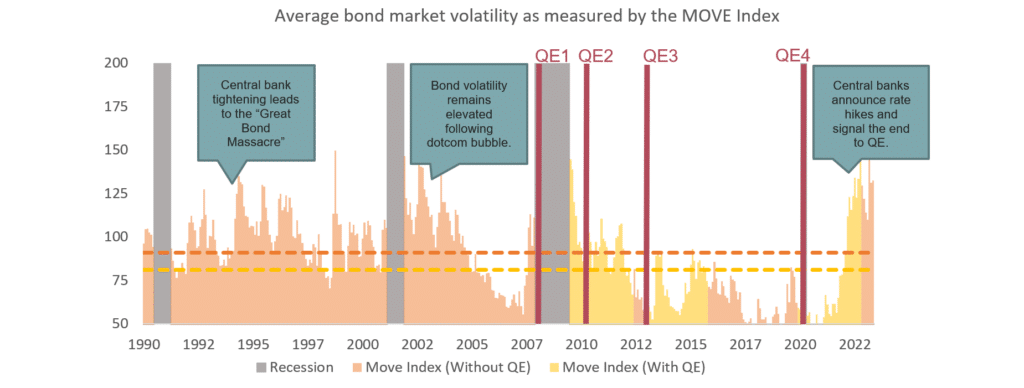

We can see this when delving into the data. If we focus on non-recessionary market environments since 1990, the average US government bond market volatility (as measured by the MOVE Index – the yield curve weighted index of the normalized implied volatility of 1-month Treasury options) is ten points lower during times of QE versus periods when QE was not in use (see Figure 1).

Figure 1: QE suppressed bond market volatility

Source: Bloomberg, Nedgroup Investments

Focusing in on the above chart, you can see that when the bond purchasing program began during the onset of the Great Financial Crisis, bond volatility was unsurprisingly elevated.

Central bank intervention resulted in a material reduction in market volatility, however the fragility of the market was such that central banks were forced to remain accommodative for some time, limiting supply. On the demand side, a lack of appetite for the meagre yields on offer meant that buyers were equally hard to come by, with purchases coming primarily from price-insensitive buyers.

The lack of excess on both sides acted as a lingering anchor on broader bond market volatility – but what were the implications of this?

Volatility’s link to active management

Imagine you compete on a weekly basis for your local ten-pin bowling team “Livin’ on a Spare”. You are a serious team, despite your questionable name, so rightfully aghast when Bernanke Bowl decides to leave the barriers up.

Your team is full of star bowlers and have become accustomed to winning a strawberry flavoured slushy after several podium finishes. This week is different though.

Instead of “The Gutter Gang” shrieking with excitement when one of their players notch a single pin, they have been able to reach a respectable score, ricocheting their way towards a strike or two. Indeed, so have all the other teams, with dispersion across the board a lot lower than normal and average scores much higher.

Having the barriers up in bowling, is akin to the impact of QE on fixed income, where we have already seen has the effect of significantly reducing volatility. With volatility low, individual bond returns become clustered around that of an index, making it incredibly challenging for even the most skilled managers to add value.

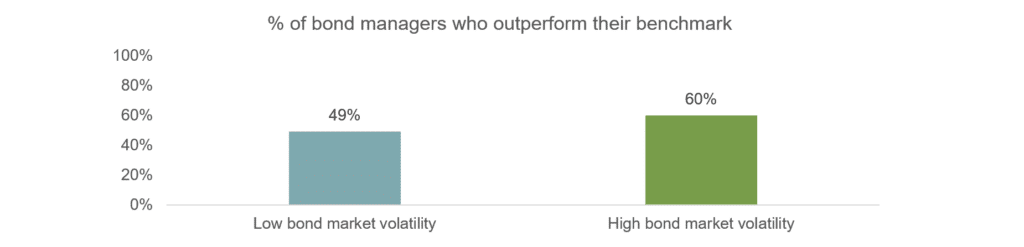

Let’s put some numbers to this. If you were to look at the proportion of active fixed income managers who outperform the benchmark, across closely tracked bond peer groups[1], you would find that only 49% of managers outperform in low volatility environments, versus 60% in high volatility environments.

Figure 2: Higher volatility has meant a higher likelihood of outperformance from bond managers

Source: Morningstar, Bloomberg, Nedgroup Investments

A huge swing, where during low volatility less than half of active managers outperform and in high volatility nearly two-thirds do. Naturally, focusing purely on average manager performance has its limitations, since it tells us nothing about the range of performances across managers.

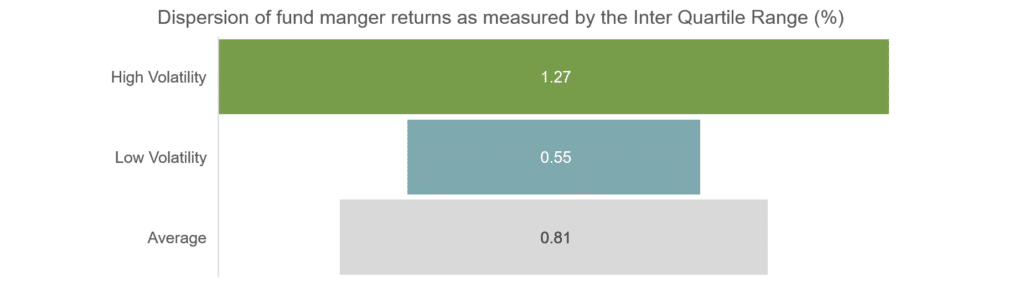

Delving into this further, we found that manager dispersion increases by over 2-times during high volatility environments compared to low volatility environments.

Figure 3: Higher volatility has brought on greater dispersion of manager returns

Source: Morningstar, Bloomberg, Nedgroup Investments

Therefore, despite volatility tending to improve the prospects for the average manager, the gap between the best and worst widens significantly.

Implications for bond investing going forward

In the same way a barrierless bowling lane highlights a truly accomplished bowling team. Volatility creates opportunities for active managers to add value for clients, by using their skill to target the most attractive bonds, avoid the worst, and in doing so allocate capital to its most efficient use. The opposite is true, however, for the unskilled manager, whose fallibility is brought to the fore by volatility.

It is reasonable to expect the recent bond market volatility to continue, and with it the fortunes of a highly skilled manager. Over the last 18 months, markets have gone through a period of abrupt transition, with central banks across the globe raising interest rates at the fastest pace in decades.

Despite signs of taking effect, the cumulative impact of this tightening is yet to be fully reflected in areas such as growth, unemployment and inflation.

Progress has of course been made on the inflation front, helped in part by falling commodity prices and general base effects. However, it is arguably too early to call victory just yet, with imbedded stickiness probable, given labour market tightness.

Furthermore, out of fear of repeating the events of the 80s (taking their foot off the break too soon and allowing the inflationary flames to regain momentum) central banks are likely to veer on the side of doing too much, rather than too little. Rates will therefore stay elevated for longer, putting pressure on sovereign ratings as debt servicing becomes strained, with rates no longer at zero (or lower bound).

But perhaps equally important, is that we are moving from a sedative period of QE to one of QT, where central banks will no longer be mopping up excess bond supply, but instead adding its own.

Moreover, this will all be happening at differing rates and intensities across the globe, as countries find themselves in very different cycles, fuelling further market volatility.

Such a high volatility environment will undoubtably have its own challenges, but it should also act as an opportunity for a highly skilled active manager to excel. The task now is finding the right one.

Clients of Nedbank Private Wealth can get in touch with their private banker directly to understand more about how we manage money on their behalf, or call +44 (0)1624 645000 to speak to our Client Services team.

If you would like to find out more about how we manage clients’ investments, please contact us on the number above or via our Contact us page.

Investments can go down, as well as up, to the extent that you might get back less than the total you originally invested. Exchange rates also impact the value of your investments. Past performance is no guide to future returns. Any individual investment or security mentioned may be included in clients’ portfolios. They are referred to for information only and are not intended as a recommendation, not least as they may not be suitable. You should always seek professional advice before making any investment decisions.

Author

Louis Hutchings

Portfolio Manager , London

Louis joined Nedgroup Investments, a sister company of Nedbank Private Wealth, in July 2019 and is a Portfolio Manager within the London team. Louis primarily focuses on macroeconomic research, helping to inform the Tactical and Strategic Asset allocation across the portfolio ranges.

At Nedgroup Investments Louis is Co-Chairman of the International Strategy Committee and a voting member of the Global Investment Committee.

Louis holds the Charted Financial Analyst (CFA) qualification, alongside a MSc in Finance from the London School of Economics and Political Science and a first class BSc (Hons) degree in Economics from the University of Birmingham. Previous experience includes internships at Investec, Capgemini and Wesleyan.

RELATED NEWS

You may also be interested in the following Insights

Sign up for our updates

Stay up to date with the latest news, insights, and opinions from Nedbank Private Wealth by signing up to our newsletter. You can also register to be invited to our virtual events and hear directly from a wide range of experts. Sign up below. You can unsubscribe at any time.