Leaving a legacy

A life preserver or build a wall? – Charity and philanthropy

Understanding the difference between charity and philanthropy can be difficult. The right option can depend on the impact you wish to make.

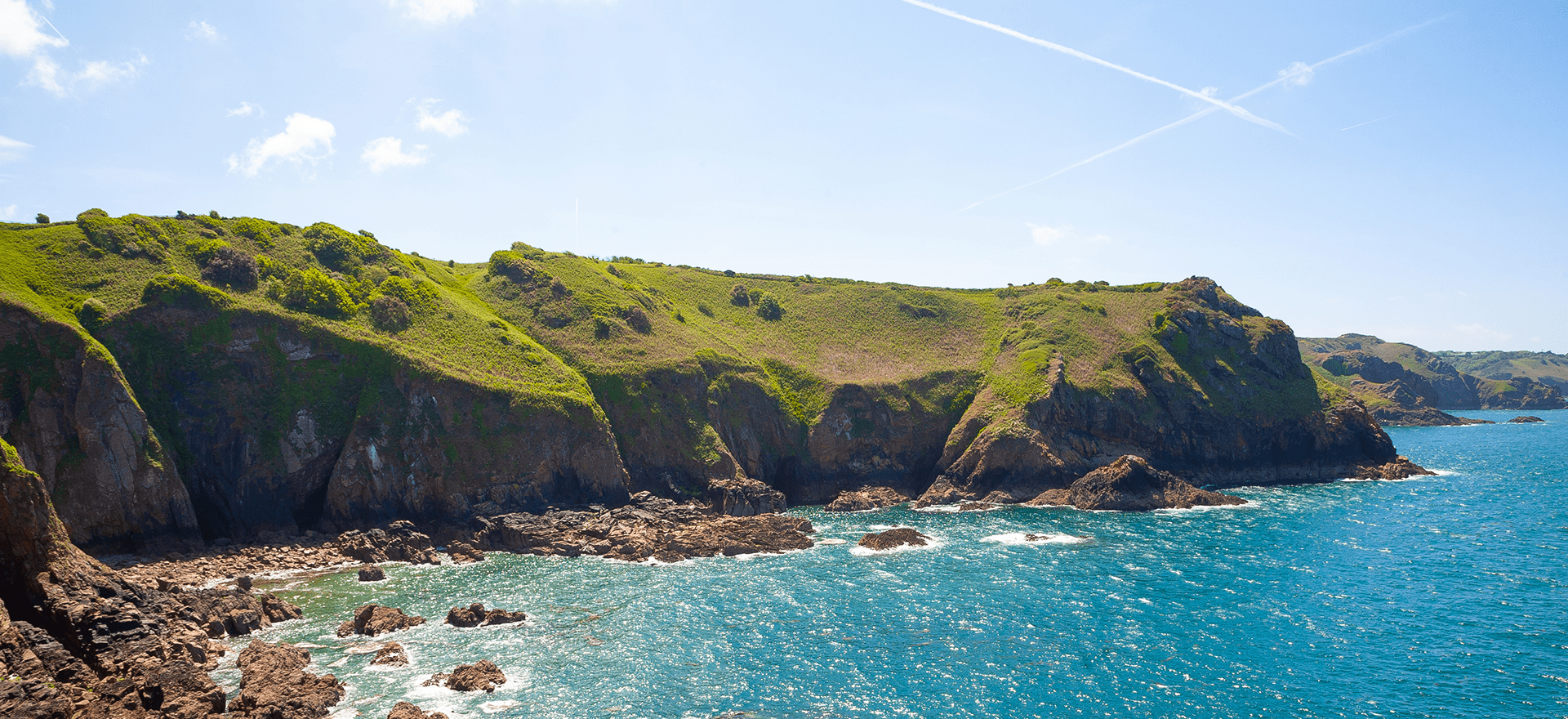

Picture yourself on the edge of a flash flood. Seawater has risen so high that it has crashed over the sea wall. Water has gathered forming a large pond. In the middle of that pond is a young man struggling to swim having been caught up in the rising waters. Distress is clearly etched on his face, he is tiring fast. This has clearly happened before, because nearby you find a life preserver and throw it out to the man, who uses it for buoyancy and is able to kick himself to safety.

You saw someone suffering and you acted immediately to affect the situation in a positive way. But the look on the man’s face will not leave you: what about the next person that gets into trouble when the floods come? What if no one is there in time to throw the life preserver? You start thinking about how you could help prevent this from happening again and to investigate what caused the flood in the first place. In this instance, experts confirm the sea wall is not high enough. And so, you get in touch with local authorities and rally support to build a better and higher sea wall preventing any future flooding, which you help pay for.

And this is a good way of demonstrating the difference between charity and philanthropy – charity looks to offer direct relief from pain and suffering (throwing the life preserver) whereas philanthropy seeks to address the root cause to effect lasting change (building a sea wall).

When put this way it is easy to see that both philanthropy and charity are very similar and very different, and both are just as important in today’s world. It is often easier to see how you can help with an emerging situation or catastrophic world event that causes suffering – it is sometimes not as easy to see how you can impact the root cause.

Now let’s follow this train of thought and consider the funding of the sea wall.

Simple, right? If you are willing to pay for it, you find out how much it costs to build the new wall and give the money to the relevant local authority.

But what if the authority doesn’t use all the money to build the wall? What if this is a big project, lasting years and you want to ensure your funds are used for the intended purpose and not squandered through corruption or negligence. If you simply hand over money you have given up your control.

Could there be a better way? Sometimes. Depending on the impact you wish to make, sometimes a lump sum is best. Sometimes regular payments are preferable. A financial professional who is versed in philanthropy should be able to guide you on the best solution. Their advice should encompass your goals, tax situation, financial position and the objectives of the cause you wish to benefit. They could also advise you on the best approach for tax efficiency. This may be the setting up a donor advised fund or foundation where the money is gifted and no longer owned by you, but you still have control over how and where it is used and obtain all of the tax relief you are entitled to. In the case of very long-term projects, the money could be invested and gradually distributed at pre-set intervals. Over time, this could increase the amount available to the charity (as the invested funds grow). Additionally, you retain control, so you may choose to change the causes that receive your support at any point in the future.

Finally, by having conversations with a financial professional that include your intentions to gift money philanthropically, they can gain better insight into you as a person, your goals and your priorities, which could also translate into how they invest on your behalf more generally (in your pension pot or legacy plan, for instance). Ultimately, this level of conversation will lead to a better partnership of trust, a better understanding of your wealth needs and an extension of your impact well beyond your philanthropic giving.

Clients of Nedbank Private Wealth can get in touch with their private banker directly to understand how we manage money, or call +44 (0)1624 645000 to speak to our Client Services team.

If you would like to find out more about how we can help clients manage their investments, please contact us on the number above or via our Contact us page.

Investments can go down, as well as up, to the extent that you might get back less than the total you originally invested. Exchange rates also impact the value of your investments. Past performance is no guide to future returns. Any individual investment or security mentioned may be included in clients’ portfolios. They are referred to for information only and are not intended as a recommendation, not least as they may not be suitable. You should always seek professional advice before making any investment decisions.

Author

Rebecca Cretney

Investment Counsellor , Isle of Man

Rebecca joined Nedbank Private Wealth in May 2004 having moved to the Isle of Man from Barcelona to pursue a course in Business Studies with the Isle of Man Business School. She worked as a private banker until 2019, when she was appointed to the role of investment counsellor. Rebecca now focuses exclusively on supporting private bankers in conversations with their clients, providing technical investment expertise where more complex portfolio requirements exist. She also provides coaching and training for the private banking teams on a wide range of subjects surrounding investment and advice. In addition, Rebecca chairs the bank’s Investment Committee.

Rebecca is a Chartered Fellow of the Chartered Institute for Securities & Investment and a Chartered Wealth Manager.

RELATED NEWS

You may also be interested in the following Insights

Sign up for our updates

Stay up to date with the latest news, insights, and opinions from Nedbank Private Wealth by signing up to our newsletter. You can also register to be invited to our virtual events and hear directly from a wide range of experts. Sign up below. You can unsubscribe at any time.